Business Savings

Running a business can be hard but saving money doesn’t have to be. Opening a business savings account and having a solid savings plan is key to building a solid financial foundation for your business. This account is great to help keep your reserve separate from operation expenses and earn interest on your money. Requires minimum deposit of $100.00 to open.

Business Money Market

If you are looking to earn more interest than you would with a savings account, a Money Market account may be the best choice for you. This interest-bearing account is available for customer who maintain a higher monthly balance and are looking for limited withdrawal privileges. Requires minimum deposit of $1,000.00 to open.

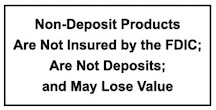

Business Certificates of Deposit (CD)

A CD is a great option to earn a set interest rate for a fixed term on money that you do not always need access to. This product is great for businesses who want to invest their money for a set amount of time ranging from 3 months to 3 years. Requires minimum deposit of $1,000.00 to open.

FDIC Insurance

With full FDIC insurance up to $250,000 you can feel secure. If you will have a larger balance, inquire with us to help ensure that all your money is secured!

Come in and see one of our Customer Service Representatives today!

Account Opening Information

Each business account requires certain documentation to be presented at account opening. Please call our Customer Service Department to get a list of what is required for your business. Some of the documents that may be required are listed below.

- Employer Identification Number

- Business License

- Articles of Organization

- Partnership/Operating Agreement

- Minutes

- Charter

Make the Switch to PEB

Changing banks can be a hassle but making the move to PEB doesn’t need to be. With our convenient Switch Kit, we’ll help get you organized and make bringing your accounts over a breeze.